The highlights from the Fresno and Clovis markets are below:

The median sold price was UP from January 2024:

- February 2024: $406,990.00

- January 2024: $399,990.00

- 351 homes sold

5.135% fewer homes were sold in February 2024 than in February 2023:

- 370 homes sold February of 2023

- 351 homes sold February of 2024.

- -19 FEWER homes sold

16.611% MORE homes sold in February of 2024 versus January of 2024:

- 351 homes sold February 2024

- 301 homes were sold in January 2024.

- 49 MORE homes sold in February than January

Average Days on Market:

- The average days on Market for homes that sold were 31 days.

- This is FEWER than January 2024.

- Days On Market (DOM) for January 2024 were 33 days

- For homes with no price changes the Average Days on Market is 18 days.

Sales Price versus Offer Price was 99.2%

- For homes with 1+ price changes the Average Days on Market is 60 days

- Sales Price versus Offer Price was 94.5%

- Median For Sale Price $438,812.00 versus Sold Price of $406,990.00

2 bank owned properties sold.

- This is a smaller OREO property than in January (5).

406 homes went under contract.

465 new properties were listed for sale.

Months Supply Inventory (MSI) of 1.4 months.

2024 Inventory levels

- January MSI: 1.4 Locally versus The National Association of REALTORS 2.0

- February MSI: 1.5 Locally, The National Association of REALTORS: 1.7

- 2023 Inventory levels have fluctuated

- January MSI: 1.8 Locally versus The National Association of REALTORS 2.5

- February MSI: 1.7 Locally versus The National Association of REALTORS (1.9)

- March MSI: 1.2 Locally versus The National Association of REALTORS (1.3)

- April MSI: 1.1 Locally versus The National Association of REALTORS (1.3)

- May MSI: 1.1 Locally versus The National Association of Realtors, 1.1

- June MSI: 1.3 Locally versus The National Association of Realtors, 1.2

- July MSI: 1.4 Locally versus The National Association of Realtors, 1.4

- August MSI: 1.7 Locally versus The National Association of REALTORS (1.7)

- September MSI: 1.8 Locally versus The National Association of REALTORS (1.9)

- October MSI: 2.0 Locally versus The National Association of Realtors: 1.8

- November MSI - 2.2 Locally versus The National Association of REALTORS 2.2.

- December MSI - 2.3 Locally versus The National Association of REALTORS 1.9.

Economists describe a balanced real estate market as having 6 months of supply; a seller’s market would be less than 6 months supply; a buyer’s market would be greater than 6 months supply.

The Fresno and Clovis markets still have low levels of inventory. The local market did not reach 5000 closed units.

Mortgage defaults are insanely low.

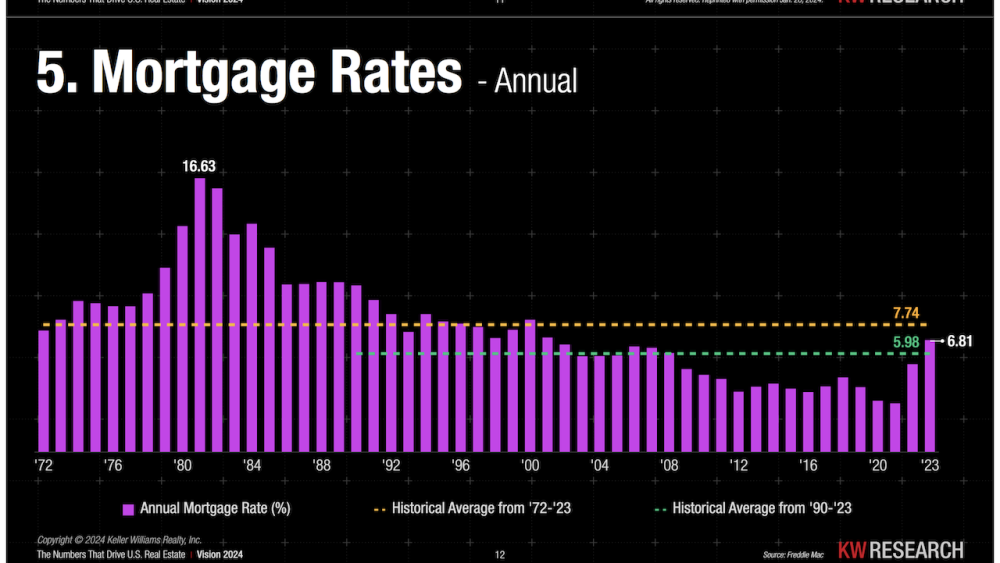

Over the last decade, we’ve had preposterously low interest rates.

We are experiencing inflation because of the Federal Reserve has increased the money supply by 40%

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman